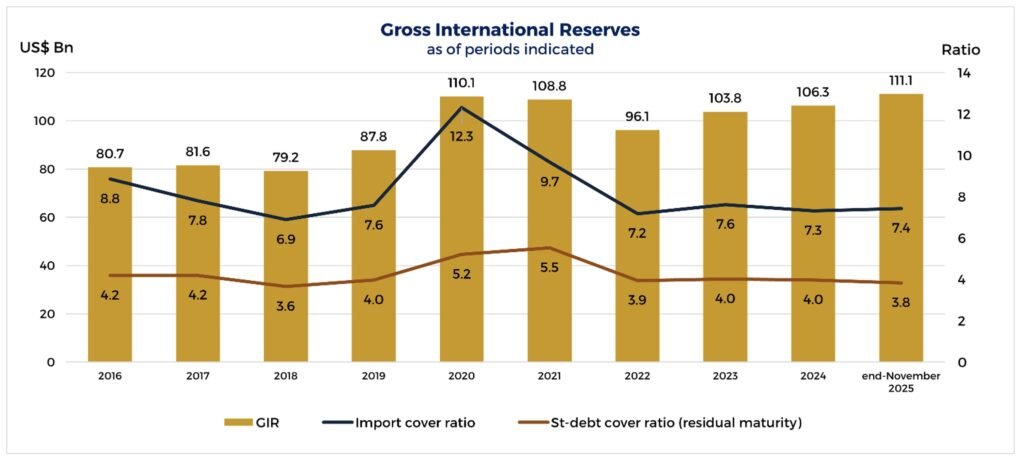

The Philippines’ Gross International Reserves (GIR) climbed to US$111.1 billion as of end-November 2025, based on preliminary data. This solid reserve level provides a strong external liquidity buffer—equivalent to 7.4 months’ worth of imports of goods, services, and primary income. [1] It also covers about 3.8 times the country’s short-term external debt based on residual maturity.[2] [3]

GIR consists of foreign-denominated securities, foreign exchange, gold, and other reserve assets that help the country finance imports, meet foreign debt obligations, stabilize the peso, and withstand external economic shocks.

[1] 𝐵𝑦 𝑐𝑜𝑛𝑣𝑒𝑛𝑡𝑖𝑜𝑛, 𝐺𝐼𝑅 𝑖𝑠 𝑐𝑜𝑛𝑠𝑖𝑑𝑒𝑟𝑒𝑑 𝑎𝑑𝑒𝑞𝑢𝑎𝑡𝑒 𝑖𝑓 𝑖𝑡 𝑐𝑎𝑛 𝑓𝑖𝑛𝑎𝑛𝑐𝑒 𝑎𝑡 𝑙𝑒𝑎𝑠𝑡 𝑡ℎ𝑟𝑒𝑒 𝑚𝑜𝑛𝑡ℎ𝑠’ 𝑤𝑜𝑟𝑡ℎ 𝑜𝑓 𝑖𝑚𝑝𝑜𝑟𝑡𝑠 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑎𝑛𝑑 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 𝑜𝑓 𝑠𝑒𝑟𝑣𝑖𝑐𝑒𝑠 𝑎𝑛𝑑 𝑝𝑟𝑖𝑚𝑎𝑟𝑦 𝑖𝑛𝑐𝑜𝑚𝑒. 𝑇ℎ𝑒 𝑙𝑎𝑡𝑒𝑠𝑡 𝐺𝐼𝑅 𝑙𝑒𝑣𝑒𝑙 𝑒𝑛𝑠𝑢𝑟𝑒𝑠 𝑡ℎ𝑒 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑜𝑓 𝑓𝑜𝑟𝑒𝑖𝑔𝑛 𝑒𝑥𝑐ℎ𝑎𝑛𝑔𝑒 𝑡𝑜 𝑚𝑒𝑒𝑡 𝑏𝑎𝑙𝑎𝑛𝑐𝑒 𝑜𝑓 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 𝑛𝑒𝑒𝑑𝑠—𝑒𝑣𝑒𝑛 𝑢𝑛𝑑𝑒𝑟 𝑒𝑥𝑡𝑟𝑒𝑚𝑒 𝑐𝑜𝑛𝑑𝑖𝑡𝑖𝑜𝑛𝑠 𝑤ℎ𝑒𝑛 𝑡ℎ𝑒𝑟𝑒 𝑎𝑟𝑒 𝑛𝑜 𝑒𝑥𝑝𝑜𝑟𝑡 𝑒𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑜𝑟 𝑓𝑜𝑟𝑒𝑖𝑔𝑛 𝑙𝑜𝑎𝑛𝑠.

[2] 𝑆ℎ𝑜𝑟𝑡-𝑡𝑒𝑟𝑚 𝑑𝑒𝑏𝑡 𝑏𝑎𝑠𝑒𝑑 𝑜𝑛 𝑟𝑒𝑠𝑖𝑑𝑢𝑎𝑙 𝑚𝑎𝑡𝑢𝑟𝑖𝑡𝑦 𝑟𝑒𝑓𝑒𝑟𝑠 𝑡𝑜 𝑜𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 𝑒𝑥𝑡𝑒𝑟𝑛𝑎𝑙 𝑑𝑒𝑏𝑡 𝑤𝑖𝑡ℎ 𝑜𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑚𝑎𝑡𝑢𝑟𝑖𝑡𝑦 𝑜𝑓 𝑜𝑛𝑒 𝑦𝑒𝑎𝑟 𝑜𝑟 𝑙𝑒𝑠𝑠, 𝑝𝑙𝑢𝑠 𝑝𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 𝑜𝑛 𝑚𝑒𝑑𝑖𝑢𝑚- 𝑎𝑛𝑑 𝑙𝑜𝑛𝑔-𝑡𝑒𝑟𝑚 𝑙𝑜𝑎𝑛𝑠 𝑜𝑓 𝑏𝑜𝑡ℎ 𝑡ℎ𝑒 𝑝𝑢𝑏𝑙𝑖𝑐 𝑎𝑛𝑑 𝑝𝑟𝑖𝑣𝑎𝑡𝑒 𝑠𝑒𝑐𝑡𝑜𝑟𝑠 𝑓𝑎𝑙𝑙𝑖𝑛𝑔 𝑑𝑢𝑒 𝑤𝑖𝑡ℎ𝑖𝑛 𝑡ℎ𝑒 𝑛𝑒𝑥𝑡 12 𝑚𝑜𝑛𝑡ℎ𝑠.

[3] 𝑇ℎ𝑒 𝐺𝐼𝑅 𝑙𝑒𝑣𝑒𝑙 𝑓𝑜𝑟 𝑎𝑛𝑦 𝑝𝑒𝑟𝑖𝑜𝑑 𝑖𝑠 𝑑𝑒𝑒𝑚𝑒𝑑 𝑎𝑑𝑒𝑞𝑢𝑎𝑡𝑒 𝑖𝑓 𝑖𝑡 𝑝𝑟𝑜𝑣𝑖𝑑𝑒𝑠 𝑎𝑡 𝑙𝑒𝑎𝑠𝑡 100 𝑝𝑒𝑟𝑐𝑒𝑛𝑡 𝑐𝑜𝑣𝑒𝑟𝑎𝑔𝑒 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑐𝑜𝑢𝑛𝑡𝑟𝑦’𝑠 𝑓𝑜𝑟𝑒𝑖𝑔𝑛 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠—𝑝𝑢𝑏𝑙𝑖𝑐 𝑎𝑛𝑑 𝑝𝑟𝑖𝑣𝑎𝑡𝑒—𝑓𝑎𝑙𝑙𝑖𝑛𝑔 𝑑𝑢𝑒 𝑤𝑖𝑡ℎ𝑖𝑛 𝑡ℎ𝑒 𝑖𝑚𝑚𝑒𝑑𝑖𝑎𝑡𝑒 12-𝑚𝑜𝑛𝑡ℎ 𝑝𝑒𝑟𝑖𝑜𝑑.