The Bank of the Philippines Islands (BPI) is providing a platform for small and medium enterprises (SME) to access various financing options to support their expansion and growth through the Ka-Negosyo Festival 2024, which will run until September 15.

Business owners and entrepreneurs can access and avail of BPI’s suite of Ka-Negosyo Loan products that are tailored to support various aspects of business operations and address different business needs.

“In BPI, we continue to support and nurture the growth of our SME sector beyond merely developing loan products. Through the Ka-Negosyo Festival, we aim to promote greater access to financing opportunities and address the concerns that SMEs have about borrowing from formal banks by introducing our SME loans and solutions that are madali, magaan, at mabilis,” said Ococ Ocliasa, Head of BPI Business Banking.

𝗠𝗮𝗱𝗮𝗹𝗶, 𝗺𝗮𝗴𝗮𝗮𝗻, 𝗺𝗮𝗯𝗶𝗹𝗶𝘀 𝗹𝗼𝗮𝗻 𝗼𝗳𝗳𝗲𝗿𝗶𝗻𝗴

Under the Ka-Negosyo Loan, BPI offers the Ka-Negosyo Loan Credit Line (KCL), which is ideal for managing recurring business expenses such as payments for raw materials and finished goods inventory, employee wages, utilities, equipment repair and maintenance, sales and distribution costs, and other on-the-spot expenses. KCL can be accessed via check issuance, BPI BizLink, BPI online, BPI app, and debit card, as clients will be able to view their account, pay bills, transfer funds, and access their ATM, among others, conveniently.

BPI likewise offers the Ka-Negosyo Ready Loan, which is suited for SMEs with seasonal working capital needs. This loan can be used for replenishing inventory and supplies, purchasing holidays stocks, or meeting harvest season requirements, ensuring businesses are ready during peak periods.

Additionally, BPI offers the Ka-Negosyo SME Loans which stands out as an ideal solution for SMEs aiming to accelerate their growth. This loan provides necessary financing for various business expansion initiatives like branching out, expanding product lines, purchasing new equipment, and meeting other capital expenditures.

The Ka-Negosyo Loan offers loan amounts from P300,000 to P30 million. Prizes are also up for grabs for SMEs who successfully apply for a loan either through the Ka-Negosyo On The Go online application or through paper application during the promo period.

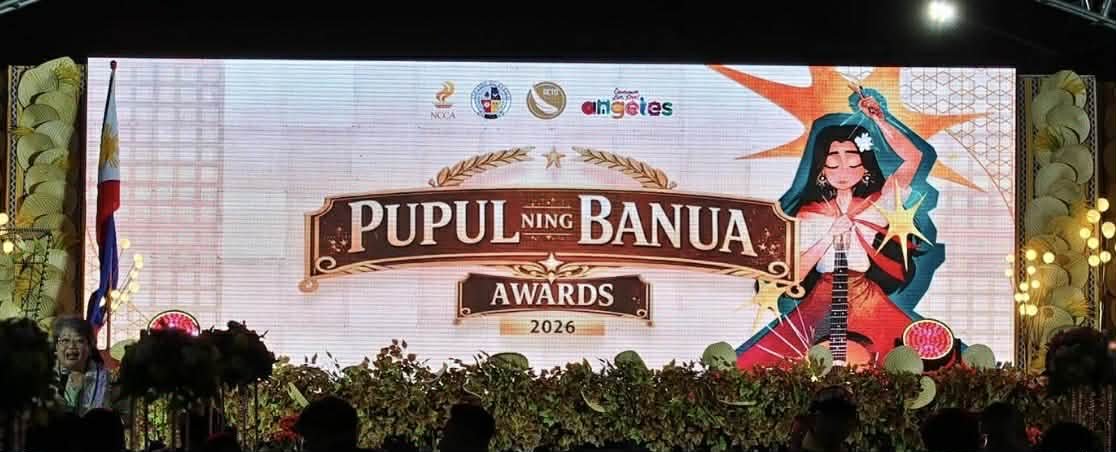

𝗞𝗮-𝗡𝗲𝗴𝗼𝘀𝘆𝗼 𝗙𝗶𝗲𝘀𝘁𝗮 𝗶𝗻 𝗣𝗮𝗺𝗽𝗮𝗻𝗴𝗮

BPI is set to hold a three-day Ka-Negosyo Fiesta at Newpoint Mall in Angeles, Pampanga from August 30 to September 1.

The event will also feature the Ka-Negosyo Loan products and other support services such as the BPI Bizlink digital banking tool and BPI AIA insurance plans, providing a one-stop shop for various business needs.

“The three-day fair is a great opportunity for Kapampangan SMEs to secure the capital and other services they need to grow and succeed. Besides offering a simplified application process, our BPI representatives at the fair will also be happy to assist them with their queries,” said Ocliasa.